#Portfolio diversification is crucial in navigating the unpredictable waters of a volatile market. With uncertainties looming, having a diverse portfolio can help mitigate risks and maximize returns. In this guide, we will explore effective strategies to diversify your investments intelligently, safeguarding your hard-earned money against potential market downturns. Stay ahead of the game by learning how to allocate your assets wisely and protect your portfolio from the impacts of market volatility.

Factors to Consider Before Diversifying

While diversifying your portfolio is crucial in a volatile market, there are several factors to consider before making any investment decisions. By carefully analyzing these factors, you can make informed choices that align with your financial goals and risk tolerance.

- Risk Tolerance: Evaluating your risk tolerance is an necessary step before diversifying your portfolio. Consider how much volatility you can handle and adjust your investments accordingly.

- Investment Horizon: Understanding your investment horizon is key in diversification. Your time frame for investing will impact the types of assets you choose and the level of risk you are willing to take.

Assessing Your Risk Tolerance

Factors such as age, financial goals, and personal comfort with risk can all influence your risk tolerance. It is necessary to diversify your portfolio in a way that aligns with your comfort level to ensure a balanced and sustainable investment strategy.

Determining Your Investment Horizon

The investment horizon refers to the length of time you expect to hold an investment before needing the funds. Your investment horizon is crucial in deciding the mix of assets in your portfolio. Shorter horizons may require more conservative investments, while long-term horizons can accommodate higher-risk investments for potentially greater returns.

Recognizing the importance of these factors can help you make informed decisions when diversifying your portfolio for a volatile market. By assessing your risk tolerance and investment horizon, you can create a well-balanced portfolio that suits your financial objectives and investing timeline.

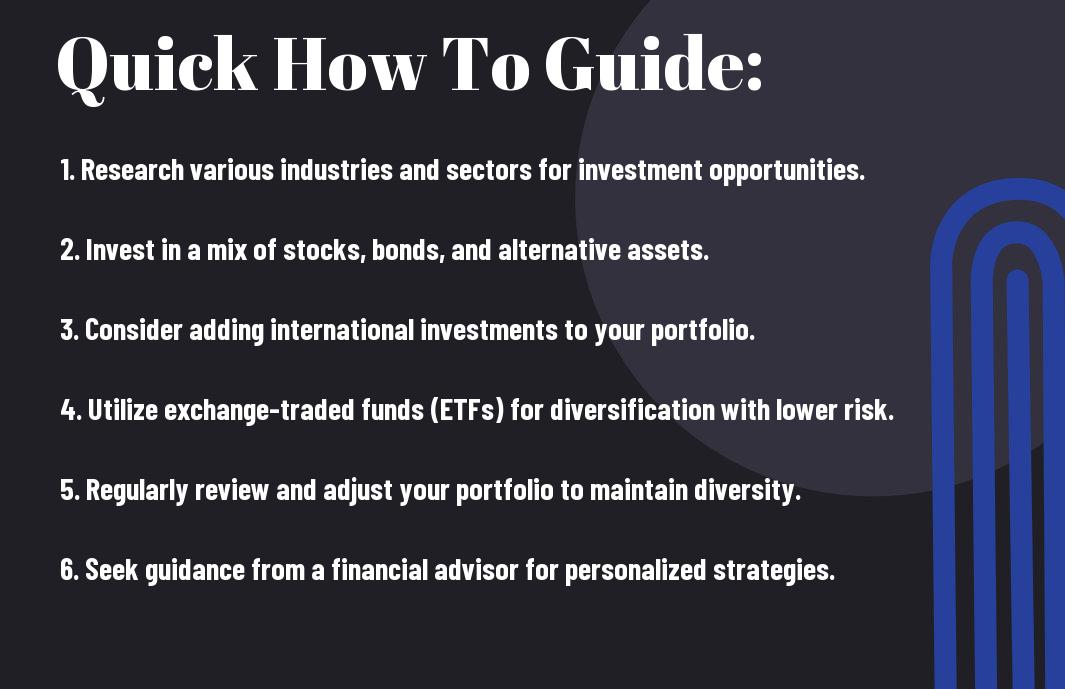

Tips for Diversifying Your Investment Portfolio

Now is the time to strategically diversify your investment portfolio to navigate through a volatile market successfully. Diversification is key to managing risks and maximizing returns. Here are some crucial tips to help you achieve a well-diversified portfolio:

- Diversify Across Asset Classes: Spread your investments across various asset classes such as stocks, bonds, real estate, and commodities to reduce the impact of market fluctuations on your portfolio.

- Allocate Across Different Sectors: Invest in a mix of sectors like technology, healthcare, finance, and consumer goods to avoid concentration risk in a single industry.

- Consider Alternative Investments: Explore alternative investments like hedge funds, private equity, and real assets to add a layer of diversification that may perform differently from traditional investments.

Perceiving the importance of diversification can help protect your portfolio from unexpected market movements. For more detailed insights, check out How to potentially preserve and grow your portfolio in a volatile market.

Investment Categories for Diversification

Some investors choose to diversify their portfolio by investing in different investment categories such as equities, fixed income securities, real estate, and commodities. This strategy allows them to benefit from the performance of various asset classes and reduce the overall risk.

Geographic Diversification

Tips for geographic diversification include investing in assets from different regions across the globe. This strategy helps spread geopolitical risks, currency fluctuations, and economic downturns. By diversifying geographically, investors can take advantage of growth opportunities in emerging markets while mitigating risks associated with any single market.

Understanding the significance of geographic diversification can help investors navigate through turbulent market conditions and achieve a more resilient portfolio. By spreading investments across various regions, investors can benefit from growth in different economies while reducing the impact of localized risks.

How to Implement Diversification Strategies

Unlike blindly investing in a single asset class, diversification is a key strategy that can help mitigate risk in a volatile market. According to Investment Diversification: What It Is and How To Do It, diversifying your portfolio across different assets can help spread risk and potentially increase returns.

Evaluating Current Investments

Strategies for evaluating your current investments involve assessing your asset allocation, identifying areas of over-concentration, and understanding your risk tolerance. It’s crucial to regularly review your portfolio to ensure it aligns with your financial goals and risk appetite. This process may involve seeking advice from a financial advisor or using online tools to analyze your investments.

Rebalancing Your Portfolio

Diversification through rebalancing involves adjusting your portfolio to maintain your desired asset allocation. This can be done by selling over-performing assets and reinvesting in underperforming ones. Rebalancing helps to ensure that your portfolio remains diversified and aligned with your investment objectives, especially during market fluctuations.

Your focus should be on maintaining a disciplined approach to regularly review and adjust your portfolio. By periodically rebalancing your investments, you can stay on track towards your long-term financial goals while managing risk effectively.

Monitoring and Adjusting Your Portfolio

Tracking Market Trends

To ensure the success of your investment portfolio, it is vital to regularly monitor market trends and adjust your investments accordingly. By keeping an eye on the performance of various asset classes like stocks, bonds, and real estate, you can make informed decisions about where to allocate your assets.

When to Make Adjustments

Market volatility can lead to fluctuations in the value of your investments. Knowing when to make adjustments to your portfolio is crucial in mitigating risks and maximizing returns. While it’s important to stay disciplined and not react impulsively to every market movement, there are certain key indicators that may signal a need for adjustments.

When the market shows prolonged downward trends, or there are significant changes in economic indicators, it might be time to reassess your investment strategy. Pay attention to any major world events or policy changes that could impact the financial markets, and be prepared to make adjustments to protect your portfolio.

Final Words

Following this 6 Steps to Consider During Volatile Markets guide can help you diversify your portfolio effectively during uncertain market conditions. By spreading your investments across different asset classes, industries, and geographical regions, you can reduce the overall risk of your portfolio and increase your chances of achieving long-term financial success. Remember that diversification is a key strategy for managing volatility and protecting your investments from market downturns. Stay informed, stay diversified, and stay focused on your long-term goals to navigate through the ups and downs of the market successfully.